It’s a fact that, even allowing for tax differences, tech products are generally cheaper in the USA than they are in Britain. British consumer magazine, Which?, believes that consumers here are being ripped off big time by global companies that see the UK as an easy touch. The publication highlights a particular Samsung television that is £755 more expensive here than in the US.

Comparing prices is difficult. For starters, local tax has to be taken into account. All British retail prices are quoted inclusive of Value Added Tax, currently 20 percent. In the USA prices are always shown net because of the wide variation between sales taxes in the various states. It is just not possible in the US to advertise a tax-inclusive price for this reason. However, with a typical state salesl tax of around six percent, which is added at checkout, there is still a big gap between the final prices in the two countries.

Apple is by no means alone in quoting showing prices in the UK than in the US, even after taking tax into account. The company has said in the past that the cost of doing business in the UK is higher than in the US and, to some extent, this is a valid comment. But it doesn’t explain the sometimes huge differences.

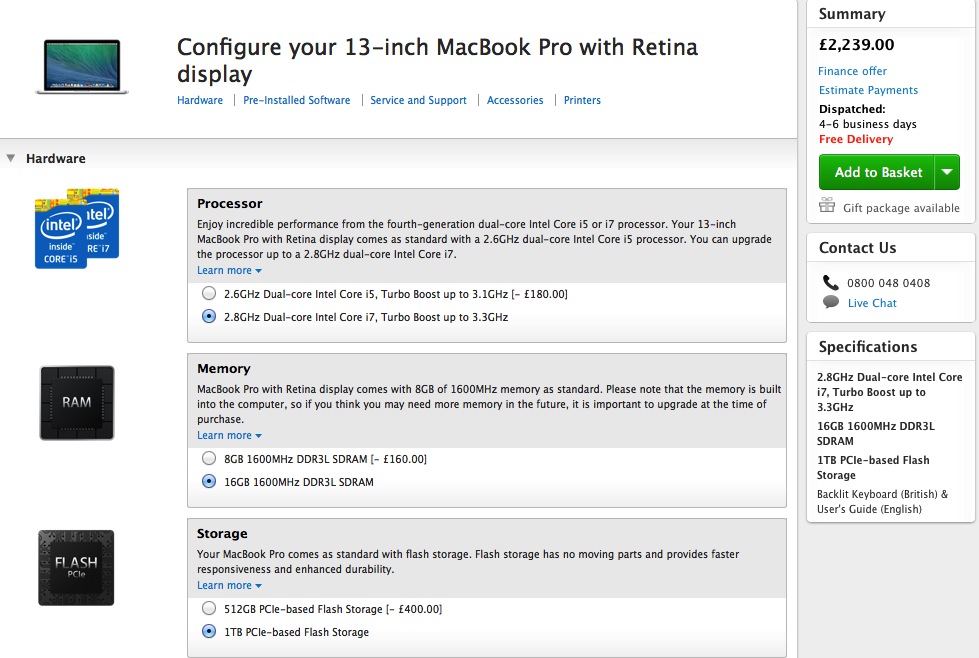

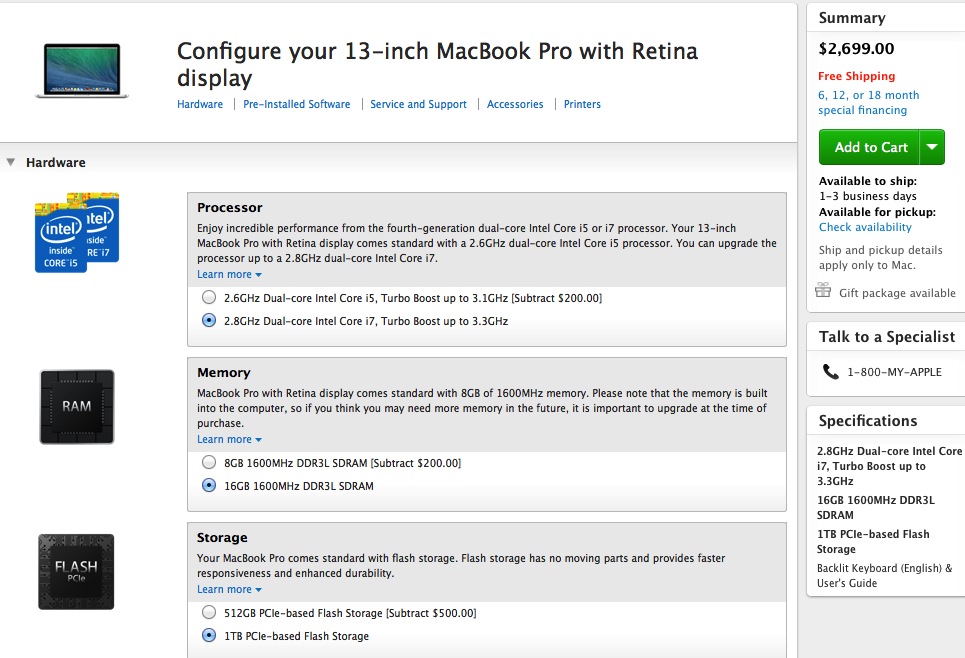

While in Washington DC last month I priced a fully-specced 13in MacBook Pro retina with upgraded processor, 16GB of memory and a 1TB SSD. This is the machine I am likely to be going for when I decide on a new computer later this year. In the USA this specification costs $2,699 before tax as you see from the screenshot. Even with, say, 6% added at the till it is still only $2,860, equivalent to around £1,685. As you can also see, the same computer bought in London will cost £2,239 or $3,825.

This is a startling difference of over $1,000. But, to be fair, we need to strip out sales tax–which is none of Apple’s concern–and compare the net UK price of £1,865 with the US equivalent, before sales tax, of £1,578 ($2,699). That’s a more reasonable difference of £287. and one, I suppose, we have to live with.

There are other factors at play. Apple, in common with all organisations, has to fix a price list and stick with it for many months. During that time a company such as Apple copes with currency fluctuations, either taking the loss or the added profit as the exchange rates change. This year, for instance, the pound is on a roll and we get a many more dollars for our pounds. As a result, goods in American stores now appear cheaper to us.

Earlier this year the pound was trading a good ten cents lower. So if we used a conversion factor of, say, $1.61 the above price comparisons (before tax) would be £1,578 to £1,676, a smaller difference of only £98.

The only thing you can say with certainty is that it is ultimately cheaper to shop in the USA because of the huge difference in sales tax between the continents. Some people, not me I would add, are prepared to break the law and attempt to smuggle in a large-value item such as a MacBook Pro in order to save a chunk of change. However, this is potentially a mug’s game because of the clear risk of confiscation. Often it isn’t just a matter of saying sorry and paying the tax, there will be penalties to pay and you could lose your computer.

So, my final conclusion is that if the tax difference is taken into account, then perhaps we are not getting such a bad deal after all. If we don’t like the tax it is our democratic right to elect a government that will slash taxes, whether direct or indirect, because this is the best way to stimulate growth.

If you want to raise your blood pressure and marvel at rip-off tech, where better to read all about it than here in the Daily Mail.

It doesn’t change the general point but 6% is on the low side. The three biggest states (CA, TX, NY) are all over 8% at the state level and local counties and cities often add additional. I live in WA and the state tax is 8.88% but the the actual rate I pay is 9.4%. Of course, if I’m willing to drive 2 hours to Oregon or find the right on-line retailer, I pay no sales tax. It’s a pretty screwed up system in that regard.

You are right, of course. I had DC/Maryland/Virginia at the top of my mind following the recent visit. Am I not right in thinking, incidentally, that in some instances there is no tax levied if an item is ordered by mail order from another state?