I’m grateful to reader Keith for some background on the success of Apple Pay in the UK. He sent me a useful link to a City AM article which lists all known companies currently prepared to accept Apple Pay transactions. It is clear that the number is growing by the day. While NFC transactions in England (probably also in other parts of the UK) are to rise from the £20 limit to £30 during September, there is good news that certain retailers are prepared to accept higher-value business if the more secure Apple platform is used (as opposed to the normal swiped credit card which is susceptible to use by thieves until stopped).

A few weeks ago I used my Apple Watch to buy a new £1,299 MacBook from a London Apple Store. I wasn’t too surprised by this since Apple has a vested interest in encouraging Apple Pay. But the City AM article tells us that quite a number of other organisations, including Marks & Spencer, Waitrose and Bill’s Restaurants have gone unlimited. This is good news and the trend, soon unstoppable, is being set.

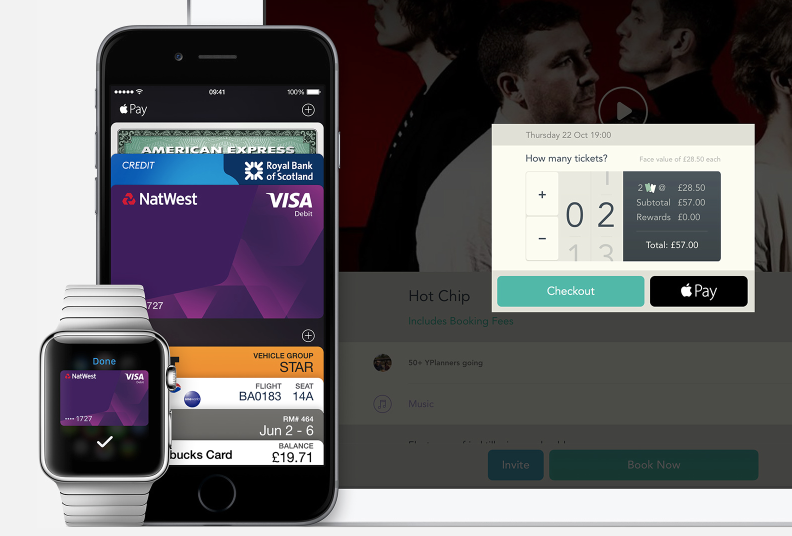

I have always said that Apple Pay will be one of the most compelling reasons to own an Apple Watch or an iPhone. Not only is it convenient and much more secure, it just makes perfect sense. It clearly makes a great deal of sense for Apple.

Despite the initial misgivings of the credit card industry, Apple is now poised to muscle in on their domain in a big way. While it is too soon to begin to recognise Apple as a bank, there are signs that the Watch and other methods of Apple Pay (don’t forget it also works with iPhones) will create a huge additional market for the the world’s most valuable company. It can be successfully argued that Apple is more respected and trusted than the majority of banks.

This potential explosion of secure NFC transaction possibilities will transform the way we pay for goods and services. It will significantly harden attitudes against cash and in favour of account-based dealing. Governments everywhere will love this trend away from cash since it enables them to track commerce and reduce the influence of the black economy. Small family businesses in some countries (‘ello, Greece, douze points) have traditionally kept several sets of books and have squirrelled away surplus cash far from the eye of the taxman. As cash payments are marginalised, there will be far less tax fraud as well as a lower rate of fraud perpetrated on the card companies themselves. The consumer will benefit in the long term.

Keith adds another bit of vital information:

An additional convenience of Apple Pay: the card details are updated automatically by the card issuer whenever you receive a replacement card. You need to do nothing at all. This is a consequence of the iPhone/Watch storing only an encrypted Device Account Number which is sent from the card issuer. Better still, it means that if you report a card (registered on the device) as being lost/stolen, then the new card details are updated immediately on the device, so you can carry on using it, whereas the physical replacement card may be days/weeks in transit

There is a more extensive list of contactless/Apple Pay retailers here, which looks more up to date, and also includes information about Amex.

An additional convenience of Apple Pay: the card details are updated automatically by the card issuer whenever you receive a replacement card. You need to do nothing at all. This is a consequence of the iPhone/Watch storing only an encrypted Device Account Number which is sent from the card issuer. Better still, it means that if you report a card (registered on the device) as being lost/stolen, then the new card details are updated immediately on the device, so you can carry on using it, whereas the physical replacement card may be days/weeks in transit.

Useful. If you don’t mind, I’ll add this as a quote at the end of the article.

No problem.

There is a more extensive list of contactless/Apple Pay retailers here, which looks more up to date, and also includes information about Amex: http://contactless.life/retailers/