For nearly ten years, I have been commenting on the move away from cash. In 2014 I was telling readers that cash would no longer be accepted on London’s bus network. Then, two years ago, I recounted my experience of using the Apple Watch as a convenient contactless payment method.

Even at that time, my use of cash was minimal. Now, in 2021, it is non-existent. You may be interested to read of my experiences. I fully expect to get shot down in flames, although the indignation wanes with every year that passes.

Coin famine

I can confidently say that I haven’t had a coin in my pocket at any time in the past twelve months. Coins do not feature in my life any more. In fact, the only coin I can remember fondling since 4th end of 2019 is the commemorative crown (five shillings, 25 pence) which I found in my desk drawer on Christmas Eve.

Notes, or bills, have similarly been banished except, that is, for the same single £10 note I have kept in my wallet since the beginning of 2020. I have never needed to use it, and it is there solely for emergencies. In fact, it’s good that paper has been banished in favour of the current polymer bill; it lasts much longer in the wallet.

Time was when I would scoff at people paying for a coffee with a credit card. Time wasters, I thought, as I fumed in the queue at the Starbucks counter. Soon I realised it was quicker to swipe than to pull out coins or wait for change. Suddenly, about two years ago, I lost my inhibitions and now pay for all everyday items with my Apple Watch (linked to a credit card) or the card itself.

There is now talk in Britain of increasing the swipe-card limit from £30 to £100, thus knocking another view nails into the coin coffers.

Cash not king

I have become rather militant in outlook. If a business doesn’t accept electronic payment, I walk out. There’s always one next door that does.

Many, I know, will find this attitude intolerable (so let’s hear from you). Why should we be forced to use electronic payment methods? In reality, I don’t feel forced into anything. I discipline myself because it’s what I want to do.

A happy corollary of this new-found freedom is the ultra-minimal wallet. I’ve always tried to be economical in the contents of my wallet. Some, I know, carry around vast compendiums, often stuffed with dozens of cards and useless impedimenta, to the degree that they are incapable of fitting into a pocket.

How often have you seen fat wallet man, invariably a man, carrying his vast wallet, keys, and phone in hand? I’ve never quite understood this. Perhaps it’s meant to impress on the basis that more cards equal more credit and therefore greater wealth.

I don’t even bother with loyalty cards unless they can be uploaded to the Apple Watch and I carry only what I deem to be essential. At the moment this boils down to:

- One credit card

- My free travel pass to take me around London and on local buses throughout England. At the moment, this indispensable little card this cannot be loaded to phone or watch.

- One £10 note for emergencies (not that I’ve had one in the past uneventful year)

We are fortunate in Britain in that we need nothing else in our wallets. Identity documents do not exist, hereabouts. We don’t even need to carry our licence when driving. So that’s it, and I can’t wait to get rid of the physical travel pass so I can get down to just one thin bit of plastic.

No travel, no cash

Some countries, such as Sweden, are even more advanced in “no-platforming” cash. But other areas of Europe are still living in the last century when it comes to acceptance of cashless payments. Indeed, one of the reasons I have been able to go a whole year without handling cash is that I haven’t been abroad because of the pandemic. By the time the gates at Heathrow reopen, I’m hoping that everywhere I visit will have caught up with us in the cashless stakes.

Of course, there are valid counter-arguments to electronic payments. What happens if there’s an electricity cut and you can’t buy a prawn sandwich? What happens if the systems go down for other reasons? What happens if there’s a coup and they close down the internet?

These are all possibilities, I admit. I remember once, about two years ago, suffering a power cut my area of London. That was quite an event. No traffic lights, no lights anywhere and no way of paying for my cappuccino. Most shops had to close, not for the lack of internet but because their cash tills didn’t work; that’s another issue.

Thankfully, such occasions are very rare, almost to the point of not featuring in the equation. And I do have my good old £10 cash to fall back on.

The one major objection to going cashless is worry about government snooping. It’s a valid concern, but I remain sanguine. The worry is that, if there is no cash in use, everyone has to use bank accounts. And bank accounts mean less opportunity to evade tax. If you work for cash and don’t pay tax, how do you use that cash or pay it into your bank account? I do, however, accept the convenience cashless payments, with all the potential for snooping, in the interests of an easier life.

This brings me to the subject of who really needs cash…

Big bills

One strange by-product of the cashless society, which I mentioned in my previous article, is the denomination of currency notes and the effect on cash use.

Our neighbours in the Eurozone can stuff a wad of blue €500 notes in their wallets (just in case…). They also have the joy of €200 and €100 notes to play with. I absolutely do not understand this; at least the €500 note is banned in the UK because of criminal abuse. Why would any law-abiding citizen wish to use such large denominations, I wonder?

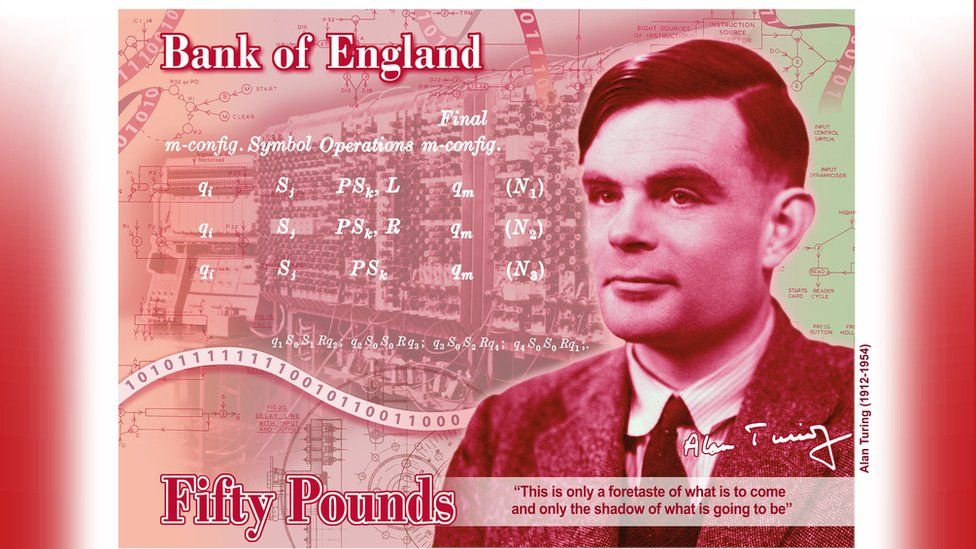

I think we’ve been more sensible with our currency in England and Wales and this directly minimises the opportunity for tax evasion. As local readers will attest, £20 ($27,€23) is the highest denomination in general circulation. A £50 note exists, but I can’t say I’ve seen one this side of the pandemic. ATMs don’t dispense them, and I really don’t know why they keep printing them. But it’s obvious what they are used for, illegal stuff, as recounted in this lively video:

The obvious course of action is to withdraw all £50 notes and then investigate anyone who turns up at a bank with a suitcase full. Inevitably the gains will be ill-gotten.

I believe the USA is similar in outlook to England and Wales when it comes to large denominations, with the $100 bill (£72) being the largest in general circulation.

Just for the record, the £50 limit applies only to England and Wales. Scotland and Northern Ireland do have their own £100 notes. Perhaps someone will tell me the reason. But if you are wondering why these countries have their own currency notes, take a look at the £100,000,000 Bank of England note, below:

I’ve set my course and it’s been pretty plane sailing so far. With my wafer-thin wallet and a pocket free of jangling coins, I believe I’ve almost reached cashless Nirvana. I am pretty sure that within ten years cash for everyday transactions will be a curiosity in many countries.

What do you think? Are you still a cashofile and, if so, why? Are you planning to go cashless anytime soon? Are you a fan of the €500 note, the $100 bill? And if you live in Europe, what justification is there for the existence of €500 and €200 denominations, if not for nefarious purposes?

Hmmm, Mike.

Since a £10 note, carefully placed in a wallet on leaving the house for a journey from one side of town to the other, will be only worth £5 by the you arrive, there does seem little point in using cash.

I am hoping for the realisation of simpler and more convenient methods of transferring BTC to a merchant or other payee.

It will then be even more convenient than those items that you have to lug around currently.

What is more, the worst kind of people will not be able to take advantage of a passing interest that one may have shown in any product or service that might be available on that journey.

I am not in favour of the current trend for globalism, but a truly global currency is something to look forward to.

Oh, Shrove Tuesday tomorrow, pancakes, or should that be crepes.

At the moment the cash is going up in value. Enough to buy a couple of pancakes tomorrow…

I don’t think I have carried cash in the US for the last five years. Everything is paid for with card. When traveling I normally do, but day to day – never. I don’t use apple pay or iphone / iwatches etc. so its all debit card for me.

Mike,

Here’s a story from the UAE in 2010 but the situation may well be the same there now.

When a company sent a termination letter to an employee, for example prior to a transfer back to the UK office, they often beforehand sent a copy to the bank and the employees’s account was immediately frozen.

In 2021 it’s still important to settle all ones’ bills for electricity, telecoms or car loan etc and get a final release paper from the bank before trying to leave the country. Then one can go with a clean slate and can be welcomed back to a new job rather than to the local jail. It’s worth bearing in mind that to bounce a cheque in the UAE is a criminal and jailable offence. That’s one reason why so many Porsches were dumped at the airport with ‘Sorry’ written in lipstick on the windscreen.

Anyway, my company was downsizing after the crash of 2008 and expat employees were returned to their home offices. Word went around and for months before the inevitable day came immediately our salaries were paid in we went to the bank and withdrew the lot in cash. Then piles of notes went into safes or under the mattress etc. Debts were paid piecemeal as necessary.

So, we never know how we may be caught between the processes of governments, banks and employers and in those instances cash is still very much king!. Not that such a thing would ever happen here in the UK :).

I went to live in Dubai in 1984 and spent five wonderful years there when Dubai was the biggest playground in the world. I’d like the share two cash related stories, the first being when I went to the Honda Showroom to buy a new car. I asked the salesman how he wanted me to pay and he looked at me as though I’d come from another plant; cash of course and so I had to go to the bank and return with a bag full of Dirham notes.

Someone earlier mentioned about buying a Leica camera with cash; also in Dubai I bought a Nikkor 500mm Mirror lens with COINS. Every evening I used to throw my coins in an empty coffee jar. Some years and coffee jars later I had enough to buy the lens. I went to the shop and asked if he’d accept the coins, which he agreed to. I’m not sure if he thought I was joking but the following day my wife and myself turned up with four carrier bags of coins as they were too heavy for just me. The guy in the shop never batted an eyelid and handed over the lens. He never even bothered to count it; that’s trust for you. Sad bit is; the lens never met my expectations and I hardly used it.

Ah! Yes, different customs. I bought a VW Golf in Greece some 18 years ago. I remember drawing out €18,000 and carrying in a supermarket bag on the bus to the dealer. That was before the Apple Watch, of course.

I recall a young fellow who was working for me in the 1980s coming in my office door one day to tell me that he had just got an increase in his credit card limit and that he had figured out that he could buy a LADA with his credit card. I told him that it was not worth getting into debt for a LADA.

As for buying cars in the Middle East, I bought a Nissan Murano in Doha about 15 years ago for about 27,000 Euros (they were over 50K in Dublin at that time) and paid by cheque which was cashed and I arranged for the chap at the dealer to deliver it to me at my apartment. The day came, but neither he nor the car arrived. I was calling him all day and I had mental images of ‘being done’. Eventually later that evening he called me and he said that he had been arrested by the Qatari police while delivering my car. His boss had just come and had got him and my car out of the ‘nick’ and he was on his way. It was a very nice car indeed with 30 extra bhp to make the extra strong A/C work in temperatures that were often above 45C in the Summer.

As for that 500mm Nikkor Mirror lens, Tom, I got one last year for nothing from a friend who had used it in Oman in the 1970s and 80s. It still had a lot of Omani sand and dust in it and, yes, it is an awful lens, Tom. The only nice feature is the way the little filters inside the lid of the case fit in the rear of the lens. Still, it was well worth getting rid of all those Emirati coins for a lens that can best be described as an historical curiosity today.

William

Hi, dude.

You are wrong or maybe just not informed on so many accounts!

Ever since autumn 2013, notes higher than 50 euros are tracked.

Since 2013 all the government connected goons had well well used 50-euro bills instead of crispy fresh 500-euro notes right out of a special bank envelope, given out by the bank. The bank itself was supporting the “crime” and to this day it is the firm habit of any bank to protect all their clients. Their business is holding your money, not interpreting any kind of laws.

No new 500-euro bills are printed and a lot are taken out of the circulation, ever since… long ago, 2014 or 2016?

500-euro bank note is purple. Not blue. Purple.

And it offers GREAT entertainment value when you use it on purpose anywhere! People scrambling up and down, now knowing what to do!

Cash is the preferred method of buying a used car. What am I supposed to use, when buying a car from another man? His birth certificate and saliva sample? Here’s the cash and bye-bye.

Sorry dude, I must be colour blind…

Thank goodness I live in Japan now where it is still VERY much a cash society. I’m the opposite to you Mike, if somewhere doesn’t accept cash, I walk out. ha ha.

I pay for everything in cash and don’t own any credit cards. never have.

Any society that doesn’t offer people a choice is not a good one as far as I’m concerned, and who’s to say that if society does become cashless, the card companies won’t slowly start taking fees every time you use it..and you’ll have to pay every time because you’ll have no choice.You don’t control the fees.They’ll be able to deduct money from your card automatically and you’ll be able to do nothing about it. Convenience doesn’t mean good.Fast food for example is convenient, but do you want to eat it all the time?

outside of the UK, the WHOLE PLANET, the card companies take their share EVERY TIME you pay with the card!

2% was the usual, but some like Master-something are being sued for taking much, much more than that.

I like your example with fastfood, it has its place, but it isn’t for everything.

I’m all in favour of choice, but the choice of cash or card should be available. I also understand that some people do have to rely on cash, but the convenience of paying by card/watch should be available to all.

Starting off I would have said that a chap with just 10 quid in paper money in his wallet was the very definition of an optimist, but I’m glad it has worked out for you, Mike. When Covid started last Spring I immediately stopped using cash (largely on health grounds) and I have only used it since for the window cleaner, in a card for my grandson at Christmas and into a safe in the church for a local priest. I still see a lot of people using cash. The groups that might use cash include the least well off who have to physically see the amount of money they have, the elderly and non tech savvy, rural dwellers and, of course, the criminal classes, which includes tax dodgers and drug dealers etc. In recent weeks there have been several cases here where the police here have arrested people with a million or two Euros in the trunk of their cars. You could buy a lot of coffee with that. However, the most recent case here in Dublin involved a non national ‘gentleman’ who was arrested with 60 cash and credit cards in a sock. It seems that they were the result of cloning operations largely done on the machines for dispensing tickets on the London Underground. The criminal classes will always find a way it seems. Reading your article I am trying to imagine that criminal with a sock full of Apple Watches.

When you do get to visit ‘the rest of the world’ again, Mike, I would suggest that you bring more than 10 quid paper money in case it hasn’t caught up. The only time I ever had a 100 Euro note was when I received it in exchange for Cuban currency (not worth the paper it is written on outside of Cuba) at Havana Airport. I kept it for some months and when I was next visiting my bank, a rare occurrence for many years, I lodged it to my account.

William

£50 notes? ..My bank’s cash machines dispense £50 notes, and I often use them.

In these lockdown days, most days see deliveries from Amazon, Hermes, DHL, Waitrose, UPS, the Post Office and others ..I hope I’m not the only one here who tips these hard-working delivery people (..though not often with a £50 note!) ..and the food take-away delivery people, too.

And when we all get back to normality (?) won’t you want to tip waitresses and waiters? I don’t think one can just add a tip to the restaurant bill and be sure that it actually gets to the people who cook and carry the food around ..all too often (..think of the Michel Roux junior scandal..) the tips go to the management and owners and not to the people who rely on those tips to bring their wages up to decent money.

Street markets, too: not everyone selling there has a card machine for taking payments. And, as Stoney Broke (above) says, what about ‘car boot’ sales? What about tipping the plumber, the painter, the builder, the taxi driver? ..You can certainly pay in taxis with a card – or a watch or an iPhone – but there are always “handling charges” subtracted from the actual amount you pay ..why let the middleman take a cut from the tip you give to your driver?

We used to keep a stack of coins to give to delivery people bringing food, eBay bargains and other parcels. But I don’t want to queue in a bank for coins during the current plague, so I get £5 notes from the cash machine, and we keep a stash of those to give to delivery people.

These are hard times for many ..so be generous with your tips!

I seem to live in a closed little world, free of all such worries!

Blimey, a bank machine with £50s. I confess I have never encountered one, but I haven’t used an ATM for about 18 months and I’m still sitting on most of the cash I drew out then. Of course, in posh suburbs things might be different…

I haven’t used cash since March last year and have no intention of going back to cash either. Except, like you, as an emergency backup.

Every shop and cafe that interests me takes card payments. I haven’t quite moved to paying by phone or watch yet, but that’s more out of inertia than anything.

My one concern over increasing swipe card limits is the risk of fraud if you lose your card. That will be enough to ditch mine altogether and use my phone.

I miss leaving tips at my local cafe, but the (young) staff are sanguine about it. Perhaps they don’t want cash either!

The privacy concerns don’t bother me too much because we’ve already given up so much privacy for the sake of an easy digital life. I suspect the banks and authorities don’t care about the people who are reluctant, because we’ll all be of a certain age and out of the picture soon enough!

And criminals can be tracked and caught in other ways.

Tips. Yes, that’s a problem I agree. I suspect it is an even bigger problem in countries like the USA where huge tips are expected, and preferably in cash.

It’s not too bad here in restaurants where 12.5% service is generally included in the bill. But it is a problem in small cafes where you might like to leave a token pound or 50p.

The swipe increase is a worry, especially if you don’t realise you’ve lost a card and therefore don’t phone the bank quickly. I’m not sure where we stand on that. A watch is a much better idea, of course, so that’s the way to go.

I am a bit of a mixed bag about this, yes I do a lot of things with credit cards, but I also use a fair bit of cash. I don’t do online banking, and I still use paper savings books in building societies.

The challenge for you Mike should be to head North to those smaller hard to reach places (when restrictions ease), and then realise having some cash on you can be useful. There are still places away from our large cities where the internet struggles, and similar to your electric vehicle charging infrastructure issues – we have the same national infrastructure issues with our internet, it does not go everywhere, and nor does 4G trust me I know places without signal or net – and there are shops.

I think it works, because you live where there is excellent connectivity. I tend to spread bet my options so I can get by – or should that be buy.

You make a good point, Dave, and I have been able to keep pure this past twelve months because there has been little to do. I did manage to get to northern parts in two occasions and never needed cash, so times are definitely changing.

The past year has been like none other in my life; so it is hardly a good test bed for any measure of normality. Ask again next year, Mike, though don’t hold your breath.

I’ll hold you to that 7/2/22 and see if I’ve given in.

In the US, you still need to carry some essentials: driver’s license, health insurance card, a debit card or credit card for when there’s no watch/phone reader, $1 bills for tips.

We’re almost there – just make sure you have backup for anything you would normally use to pay or ID yourself.

I’m in the UK, and I’m still in favour of cash. I use other methods to pay sums above about £100 (usually less) for incidentals, and some people (car boots, markets, tradesmen etc.) want cash and often the best prices come with that. It all depends on what you’re buying, and I haven’t yet tried to buy a Leica with a suitcase full of “moolah”.

The choice to pay cash for things like food, drink, and other small disbursements is one of the last few freedoms and opportunity for privacy. I don’t trust many institutions these days, least of all government, its agencies and banks, as the one is all too eager to seize personal financial information, and the other (when its not letting it be lost, misused or defrauded) is keen to give it up. I don’t particularly want to be tracked around, especially by my spending, and I don’t have a smartphone, which makes me a Privacy-loving Luddite.